THE PRESTIGE FINANCE SPECIALISTS

Enzo Ferrari, the brands founder was a veteran who fought in World War I under the Italian Army’s 3rd Mountain Artillery Regiment. Following the end of the war, he met with fellow veteran’s Francesco Barraca’s parents, Count and Countess Baracca, who suggested that Ferrari adopt their son’s logo as his own for good luck, and thus the iconic “prancing horse” logo began.

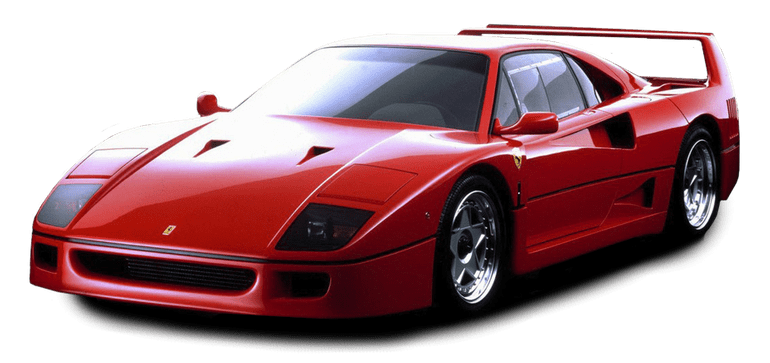

Lie many prestige car brands, Ferrari’s tend to hold their value well, with vintage models being just as popular as new ones. Some of the brands most popular models include:

- Ferrari Testarossa (1984-1991) …

- Ferrari F40 (1987 – 1992) …

- Ferrari Enzo (2002 – 2004) …

- Ferrari 360 Challenge Stradale (2003)

Interesting fact, there’s A Ferrari Theme Park in Abu Dhabi. Ferrari World opened in 2010 and boasts the world’s fastest rollercoaster at approximately 150mph, the F1-inspired Formula Rossa rollercoaster.

Why Choose Anglo Scottish

Contact us today to begin your tailored finance quote.

- Low APR

- Manual Underwriting

- Bespoke finance agreements

- Quick decisions

Need help? Call us on 0191 410 4776

Rates from 4.9% APR: the exact rate you will be offered will be based on your circumstances, subject to status, and affordability.

Representative example: borrowing £ £40,000 over 5 years with a representative APR of 4.9%, an annual interest rate of 4.9% (Fixed) and a deposit of £0.00, the amount payable would be £751.00 per month, with a total cost of credit of £ £5,060 and a total amount payable of £ £45,060.

We aim to find you the best rate available via our panel of lenders and will offer you the best deal that you’re eligible for. We don’t charge a fee for our service, but we do earn a commission. This does not influence the interest rate you’re offered in any way.

FERRARI FINANCE OPTIONS

At Anglo Scottish we can offer bespoke finance packages for Ferrari that will suit your requirements.

We offer bespoke, tailored finance packages, when you contact us our dedicated prestige finance team will go through all of your available options and reach out to our extensive panel of lenders to find the right deal for you.

Agreements available include:

HIRE PURCHASE

A flexible Prestige Car Finance solution. Monthly payments with the option to buy at the end of the contract. Our most popular form of finance for specialist and unusual vehicles.

CONTRACT HIRE

A popular form of company vehicle funding and growing as a form of personal leasing, it is effectively a form of long-term rental with fixed monthly payments based on a predetermined mileage.

PERSONAL CONTRACT PURCHASE (PCP)

One of the most popular forms of car finance, PCP agreements consist of an initial deposit followed by fixed monthly payments, and a balloon payment. At the end of the contract, you can either return the vehicle or pay off a balloon payment to keep it.

LEASE PURCHASE

Or Conditional Sale, is a great option if you want to own the vehicle at the end of the agreement. Buyers usually pay a cash deposit, or part exchange their old vehicle, then pay fixed monthly instalments over an agreed period. There are no mileage restrictions, servicing requirements, or additional charges, and the car ownership is transferred at the end of the agreement.

VARIABLE RATE

Variable rate finance options are available for agreements on high-value vehicles. Unlike other finance options, where the interest is fixed, variable rate agreements track changes in the funders house base rate.

HOW IT WORKS

Applying for finance with us is simple.